sales tax rate in tulsa ok

Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa. Tulsa County 0367.

Pull Factors A Measure Of Retail Sales Success Estimates For 77 Oklahoma Cities 2018 Oklahoma State University

This includes the rates on the state county city and special levels.

. The most populous location in Tulsa County Oklahoma is Tulsa. 2483 lower than the maximum sales tax in OK. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales. Oklahoma has state sales. Tulsa has parts of it located within Creek County Osage.

The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is 852. Tulsa Sales Tax Rates for 2022. Tulsa County Sales Tax Rates for 2022.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The latest sales tax rates for cities in Oklahoma OK state. What is the lodging tax rate.

State of Oklahoma 45. This rate includes any state county city and local sales taxes. The latest sales tax rate for Tulsa OK.

The base state sales tax rate in Oklahoma is 45. Find your Oklahoma combined. 2020 rates included for use while preparing your income tax deduction.

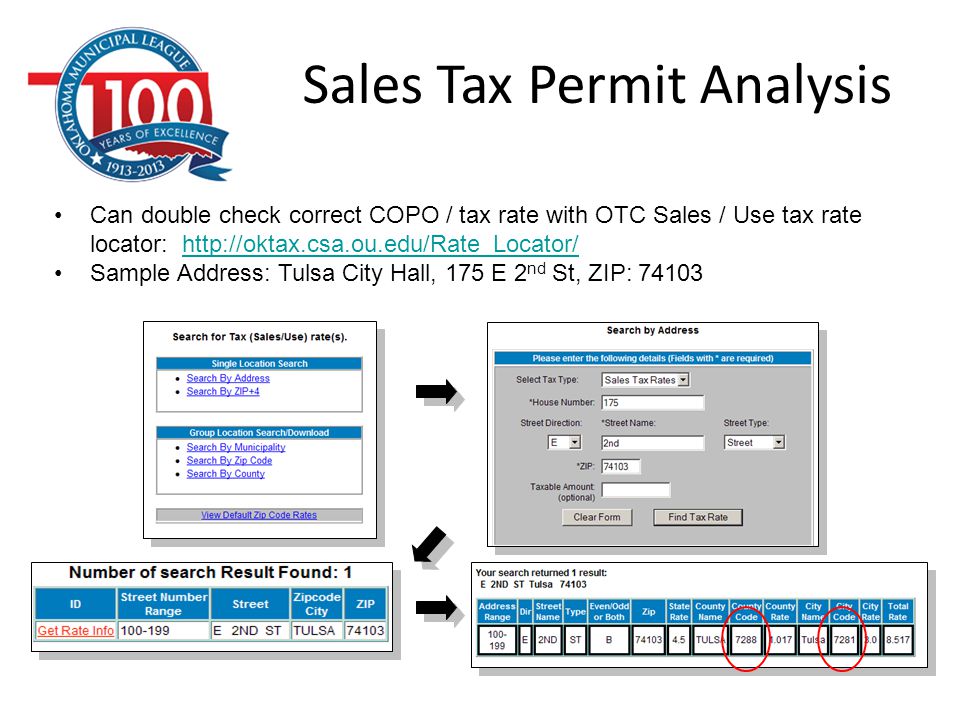

The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax.

As far as all cities towns and locations go the place with. The average cumulative sales tax rate between all of them is 828. Some cities and local governments in Tulsa County collect.

What is the sales tax rate in Claremore OK. The Bixby Oklahoma sales tax is 892 consisting of 450 Oklahoma state sales tax and 442 Bixby local sales taxesThe local sales tax consists of a 037 county sales tax and a 405. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does.

The City of Tulsa imposes a lodging tax of 5 percent. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. For the 2020 tax year Oklahomas top income tax rate is 5. The latest sales tax rate for Tulsa County OK.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365.

This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction. Rates include state county and city taxes.

The Oklahoma state sales tax rate is currently 45. The total sales tax rate charged within the city limits of Claremore is. The average cumulative sales tax rate in Tulsa Oklahoma is 831.

Average Sales Tax With Local. 2022 List of Oklahoma Local Sales Tax Rates.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Tulsa And The State Of Oklahoma Could Benefit From Online Tax Revenue Ktul

Sales Tax Holiday Weekend Arrives As Oklahoma Gets Ready To Go Back To School

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Fort Worth Proposes Slightly Lower Property Tax Rate Wfaa Com

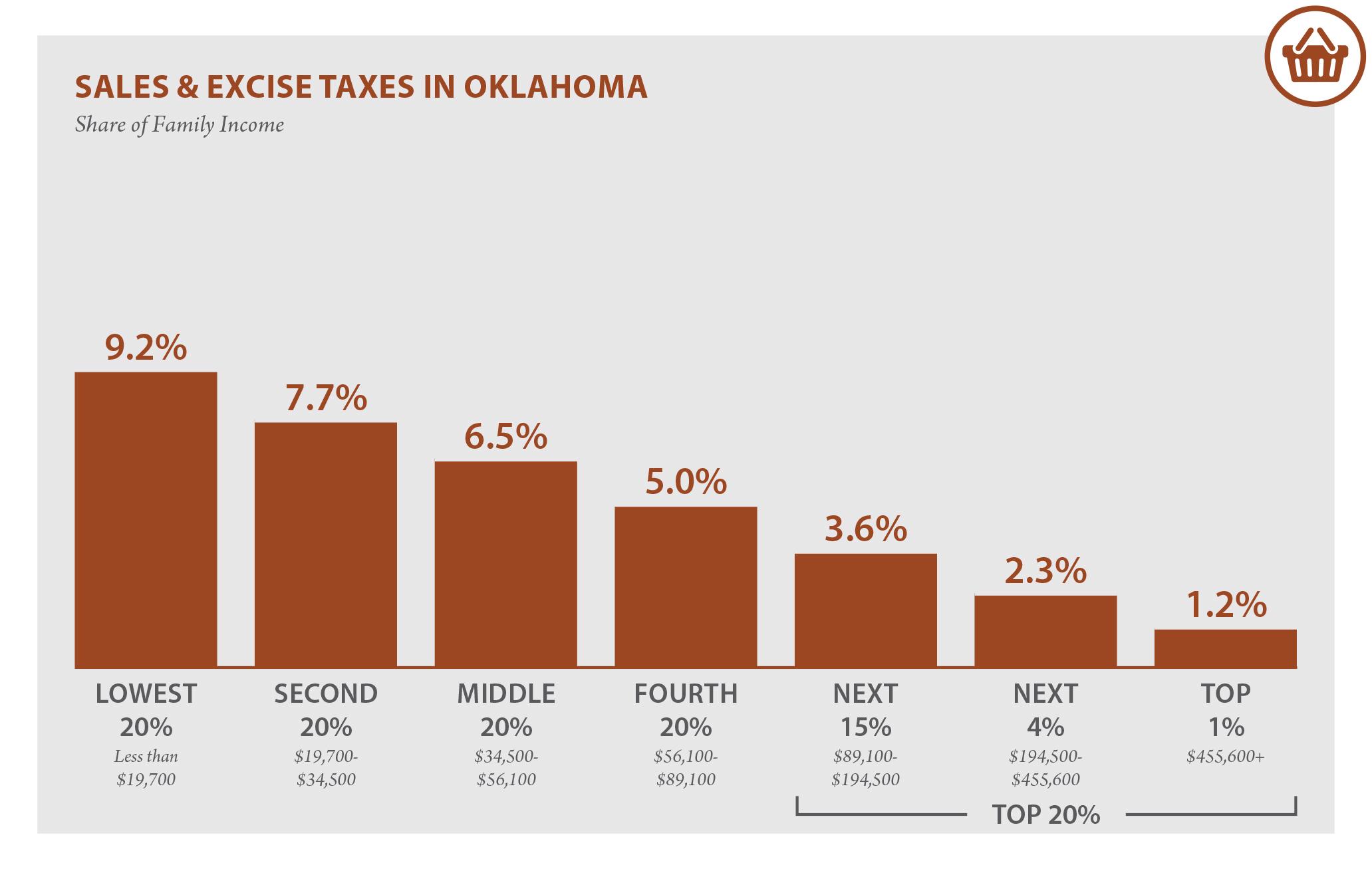

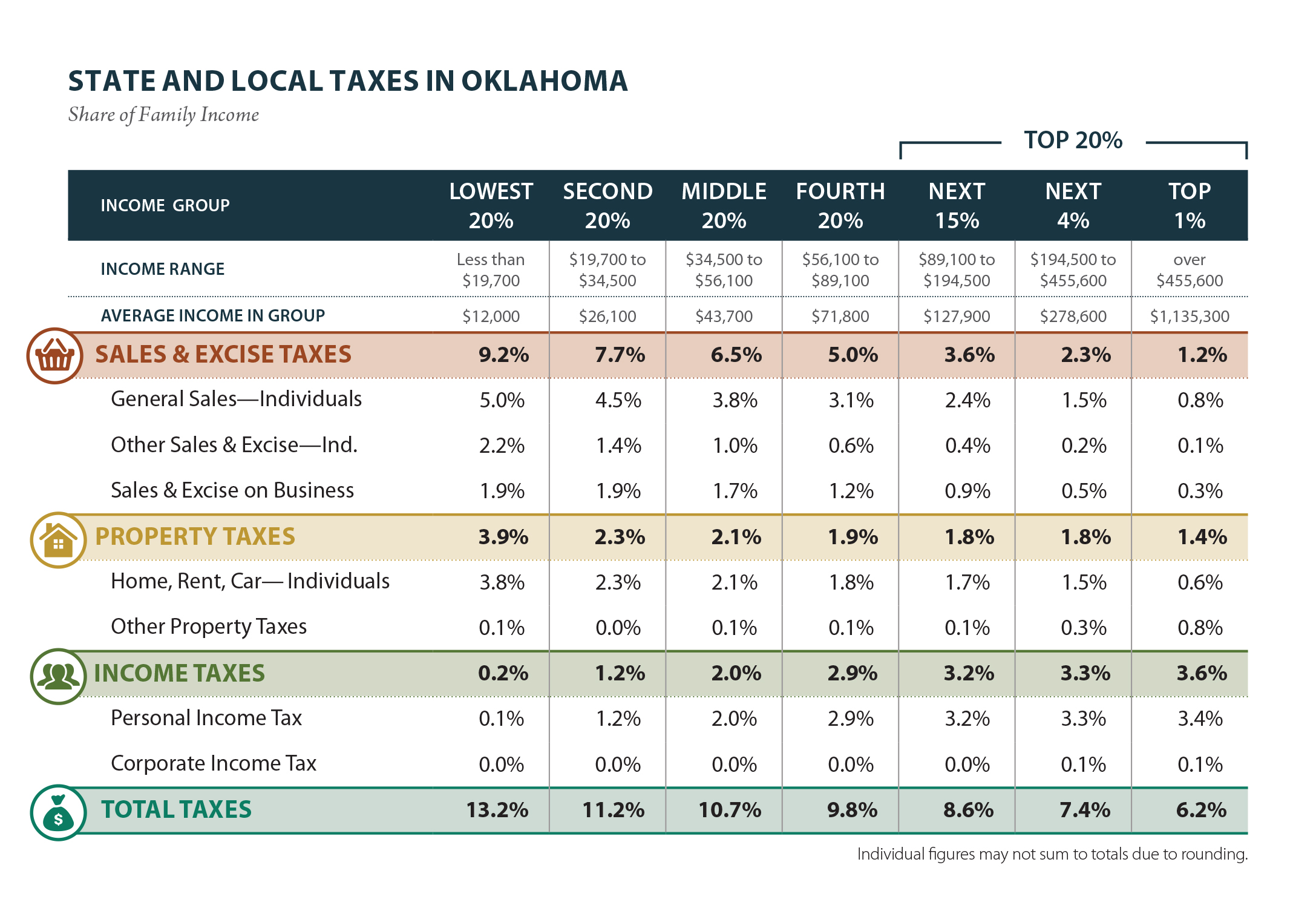

Oklahoma Who Pays 6th Edition Itep

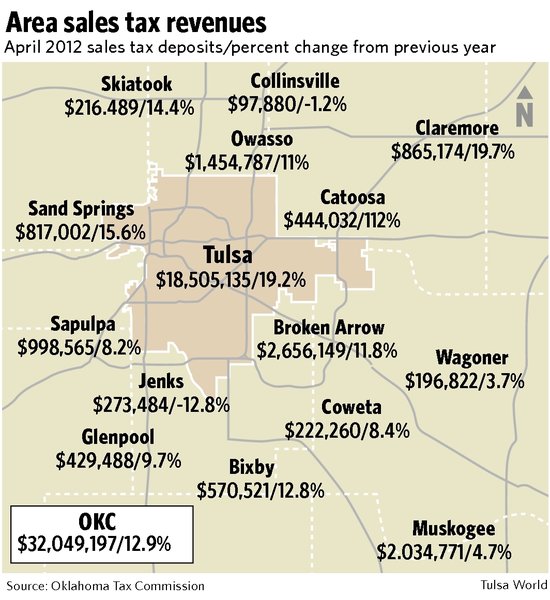

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Who Pays 6th Edition Itep

The Tax Take From Medical Marijuana By County Oklahoma Watch

Tax Free Weekend Continues Sunday Merchants Shoppers Cautiously Optimistic Education Tulsaworld Com

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

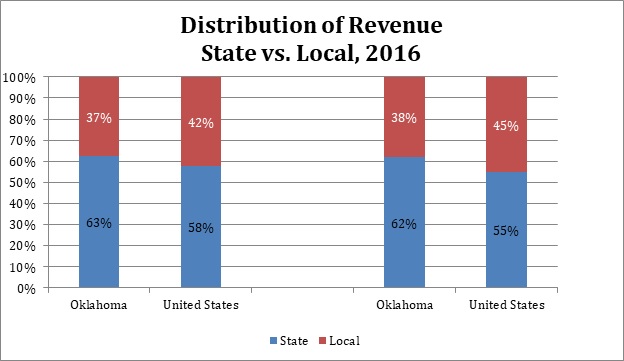

State And Local Tax Distribution Oklahoma Policy Institute

Tulsa Real Estate Market Trends And Forecasts 2020

Rent Steel Storage Containers Tulsa Ok Storage Trailer Conex Rentals

What Is The Sales Tax In Oklahoma 2021 Open The States

How To Use Otc Reports Resources Ppt Download

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

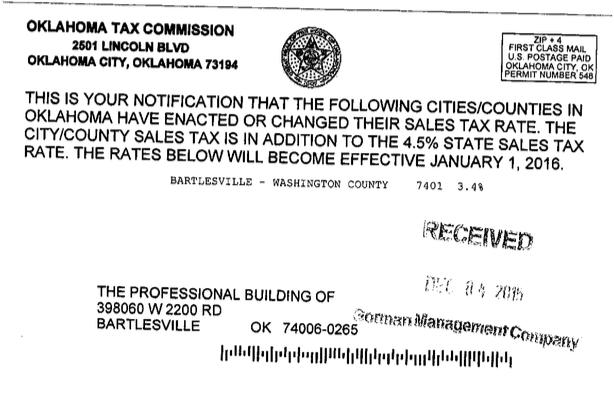

Otc Card Reflects City S Portion Of New Sales Tax Rate City Of Bartlesville